Funding Societies Builds an AI Assistant to Handle Frontline Customer Inquiries

Funding Societies used Appsmith as part of a full-stack AI-powered assistant application. The assistant provides automated customer support, reducing inquiry turnaround times and improving satisfaction rates.

- 50%

of a typical CS rep workload in the initial experiment

- Equivalent

satisfaction rates to issues handled by CS reps

- High

engagement rates

As companies grow, they face increasing challenges in managing customer interactions, processing applications, and providing timely support. This is particularly true for digital financing platforms dealing with complex financial products and services.

Funding Societies, a leading digital financing platform in Southeast Asia, found itself at this critical juncture. They aimed to scale their customer support and loan application processes without compromising quality or speed.

Implementing AI solutions in a highly regulated industry like finance comes with hurdles. Security, accuracy, and regulatory compliance are non-negotiable, making integrating AI a delicate balancing act.

Shawn Lim, VP of Platform and AI at Funding Societies, shared how he and his team used Appsmith as a key part of an innovative AI solution to transform their customer service operations.

About Funding Societies

Funding Societies is a prominent player in Southeast Asia's digital finance sector. It's a pioneering SME digital financing and debt investment platform focused on accelerating business growth through fast financing, crowdfunded by retail and institutional investors and high-net-worth individuals.

Founded in 2015 in Singapore, Funding Societies operates in Singapore, Indonesia, Malaysia, Thailand, and Vietnam and has over 500 employees. Shawn Lim, a key figure at Funding Societies, collaborates with the CTO on technical strategy. He oversees the platform and AI teams and supports other feature teams across the organization.

Shawn's role includes design reviews, leading technical projects, and developing generative AI applications. His work is vital for implementing innovative solutions that improve operations and customer service.

Efficiently managing a high volume of customer queries related to loan applications

Funding Societies' rapid growth led to a surge in customer inquiries, particularly regarding loan applications and processes. They aimed to reduce turnaround times to resolve customer issues and process financing requests. This goal was crucial, as it could significantly impact customer satisfaction and the company's operational efficiency if not prioritized.

Funding Societies recognized that addressing these challenges was vital for maintaining their competitive edge in the fintech industry. They needed an innovative approach that could leverage technology to improve customer experience, boost operational efficiency, and support their continued growth in the Southeast Asian market.

As the business expanded—coinciding with the rise of generative AI—Funding Societies' leadership team identified AI as a critical enabler for improving existing systems and processes. They saw its potential to help the company scale effectively and meet growing demand. As an experimental project, they set a three-month target to achieve a measurable impact within this period.

Funding Societies implemented an AI-powered Assistant prioritizing accuracy, security, and human oversight

Recognizing the potential of generative AI, Funding Societies launched a series of initiatives to integrate AI into their operations. They spearheaded this transformation by organizing a hackathon to generate innovative ideas. Among these, the development of an AI-powered assistant named Shane (SME Hub, Aligning Numerous Endeavours) emerged as a standout solution.

This AI assistant was designed to automate responses to common questions about loan applications and processes, reducing the workload on human customer service representatives.

To ensure the accuracy of Shane's responses, it learns from various sources like websites, helpdesk, and internal documents to provide accurate and prompt responses. It refines the knowledge base, regularly updates prompts based on customer interactions and feedback, and integrates with existing customer service platforms for consistent information. This multi-faceted approach allows Shane to provide accurate and up-to-date responses.

Security was a top priority in Shane's development. Funding Societies implemented a comprehensive "zero trust" approach to protect their AI system and customer data. This strategy involves multiple layers of security measures:

Prompt testing frameworks: The team uses open-source tools like promptfoo.dev to periodically run tests against various scenarios, ensuring the AI assistant meets quality standards and provides appropriate responses.

Strong human-in-the-loop oversight: The customer service team regularly reviews chats, marking those needing improvement. This feedback is funneled back to the engineering team for continuous refinement of the AI system.

Clear disclaimers: Every customer interaction begins with a prominent disclaimer, ensuring users know they're interacting with an AI assistant and that there's a small probability of inaccuracy.

Collaboration with internal teams: Risk, compliance, and security teams are involved in the process, conducting "red team" testing to identify potential vulnerabilities.

Implementing a robust Human-in-the-Loop (HITL) approach was vital to ensuring the quality and reliability of Shane's responses. This includes human oversight for complex inquiries or sensitive information, a system for customer service representatives to review and correct AI-generated responses when necessary, and continuous monitoring and improvement of the chatbot's performance through human feedback. They leverage the efficiency of automation while maintaining human agents' nuanced understanding and decision-making abilities.

Choosing Appsmith to develop custom internal applications for implementing HITL processes and ensuring easy maintenance

Funding Societies built their AI solution in-house rather than purchasing a SaaS product. This decision was driven by the need for a system that could handle the entire loan application journey, from initial application to repayment. While off-the-shelf AI assistants excelled at specific stages of the process, they often fell short when applied across the entire funnel.

To support their AI solution, HITL processes, monitoring, and fine-tuning tools, Funding Societies needed a robust platform for building internal applications. They had previously used a customized AngularJS codebase but encountered challenges maintaining these tools, primarily consisting of forms and tables.

To address this issue and enhance their AI oversight capabilities, they sought a solution that would allow them to create CRUD (Create, Read, Update, Delete) dashboards with minimal coding. They ultimately chose Appsmith due to its developer-centric approach, which aligned well with their needs for efficient tool development and maintenance. This choice enabled them to rapidly build and iterate on managing their AI-powered customer service solution.

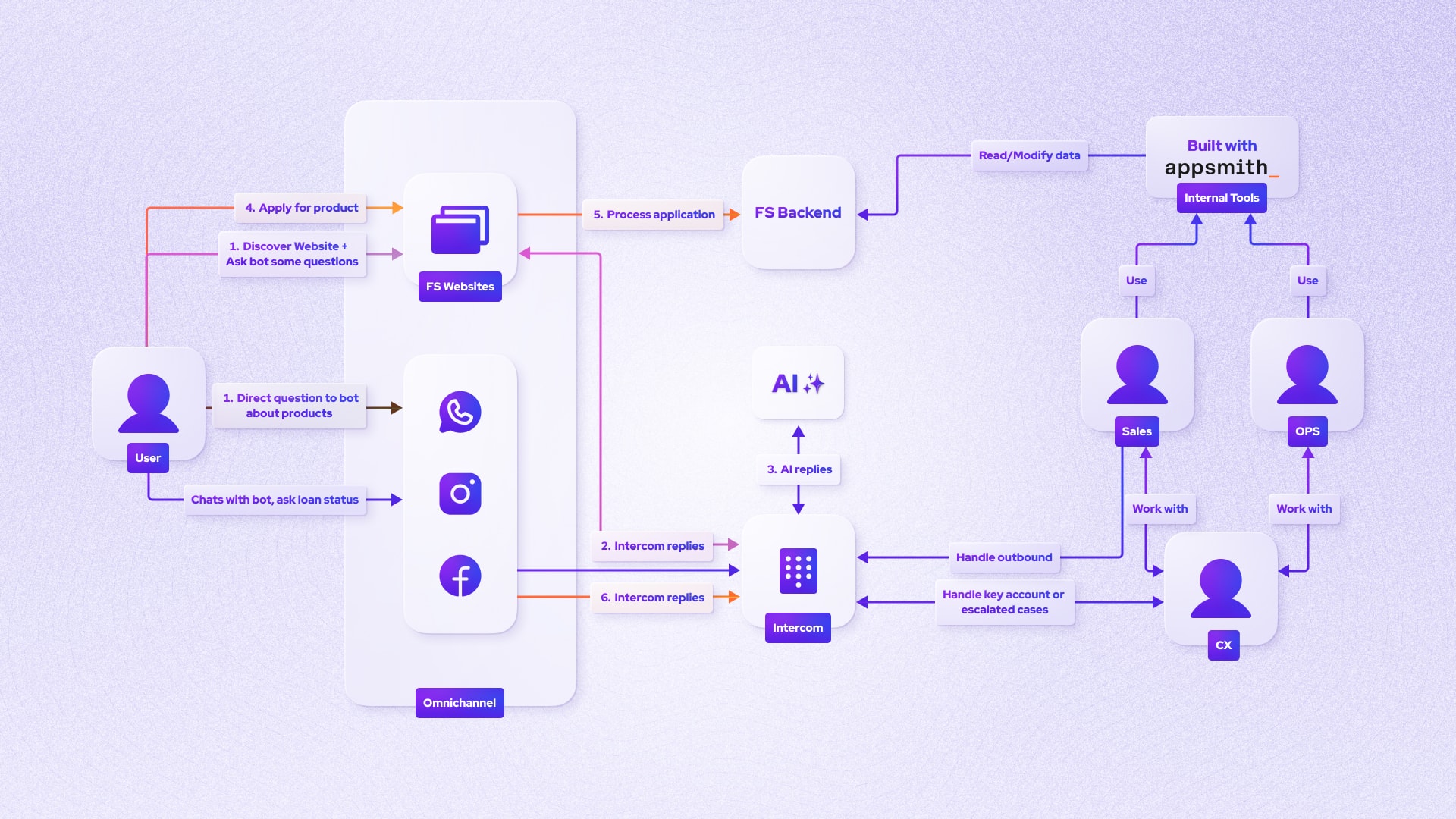

This is a high-level overview of the user flow in the system Funding Societies created using the previously mentioned tools, including Appsmith. It's based on the article "How we built our first loan application chatbot using LLMs: Part 2."

Shane reduced customer inquiry turnaround times, maintained satisfaction rates, and expanded to handle complex queries

Funding Societies' primary goal in implementing this strategy was to reduce turnaround times for customer inquiries, particularly those related to financing needs.

Initially deployed in customer support, Shane quickly demonstrated its value by handling about 50% of a typical Customer Experience representative's workload during the initial experiment. This automation reduced response times and allowed human agents to focus on more complex inquiries, improving overall service quality. The success of the AI assistant was evident, achieving similar satisfaction rates to issues that were handled by customer support representatives.

Encouraged by these positive outcomes, Funding Societies expanded the AI assistant's capabilities, training it with more extensive data to handle increasingly complex queries. It began to address sophisticated topics such as payments, repayments, fees, and financing options. Shane became capable of guiding users through every stage of their journey—from the initial application process to document approval, securing financing, repayment, and even refinancing when needed.

By creating a text-based omnichannel support AI system, Funding Societies successfully transformed its customer interaction model, providing swift, accurate, and comprehensive support at every touchpoint. This approach improved customer satisfaction and streamlined internal processes, positioning the company at the forefront of AI-driven innovation in the fintech sector.

Appsmith enables rapid development of custom apps, including tools for AI management and HITL processes

Appsmith is a low-code platform enabling businesses to develop and deploy custom applications rapidly. As AI adoption increases, companies require new architectures and interfaces for HITL reviews and management. With Appsmith, your business can speed up development, connect to any LLM, build rich copilot experiences, and make LLMs aware of relevant business data.

If you want to see how Appsmith could benefit your business, you can quickly get started with the free cloud-hosted or self-hosted application. For those seeking enterprise-grade support and reliability, we encourage you to connect with our team.

Take Appsmith out for a spin

Talk to our team about your custom requirements or request a demo.