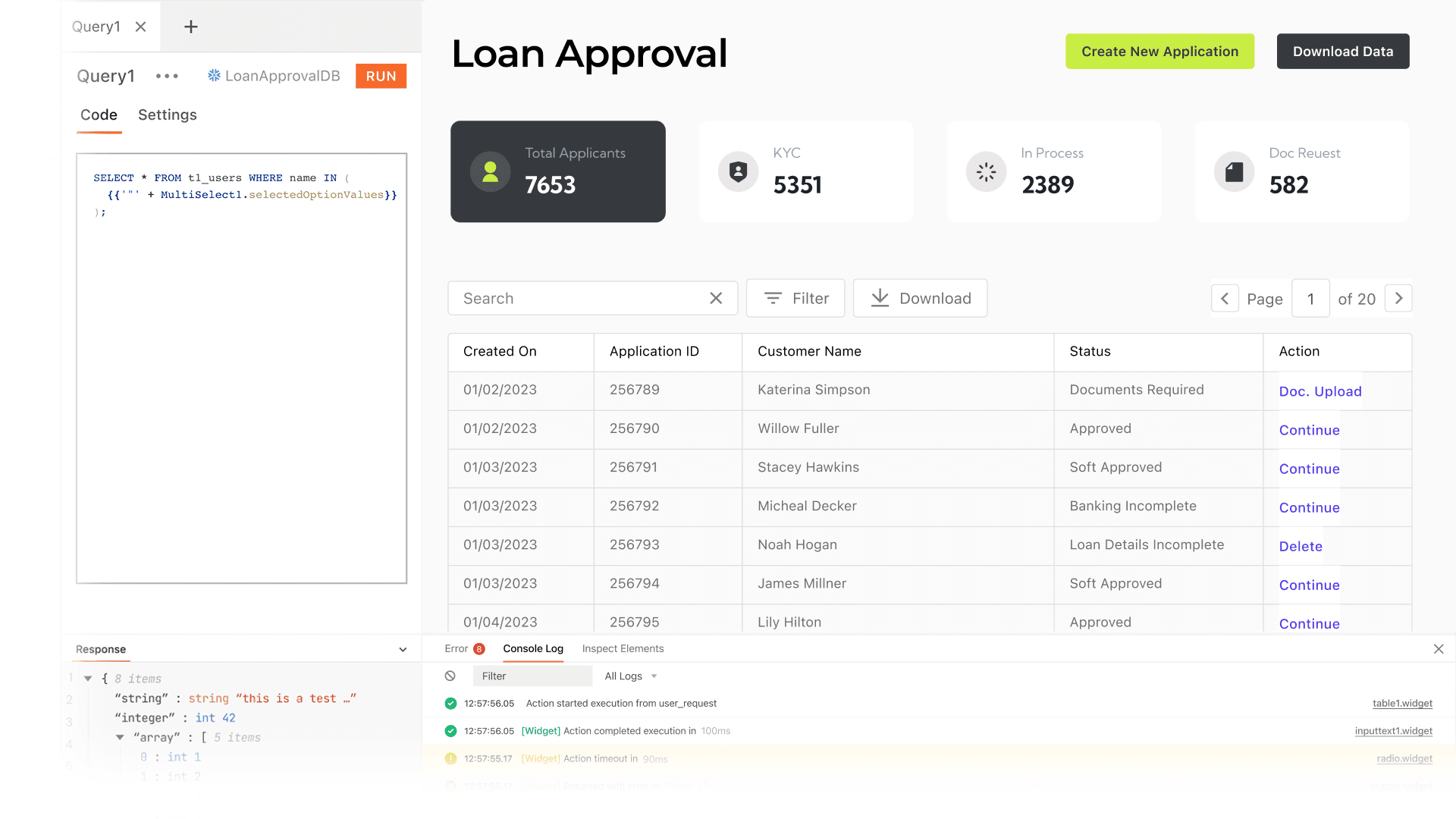

Build a loan approval dashboard in minutes.

Give your teams an intuitive dashboard to manage and monitor the entire loan approval process easily. Increase multiple teams’ productivity by bringing them all onto the same dashboard with all the data and documents related to the loan approval process on one clean UI.

What is a loan approval dashboard?

A loan approval dashboard displays all information related to the loan approval process within a company. It can include the status of loan applications, the number of loans approved or denied, and the average time it takes to process an application, and more.

What are some common features of a loan approval dashboard?

What are some common features of a loan approval dashboard?

Application tracking: for users to view their application status along with the stage their application is at and any outstanding documentation or information needed.

Reporting and analytics: for generating reports on loan application data, such as the number of loans approved or denied, the average time it takes to close an application either way, or the total value of loans approved or denied in a certain time period.

Workflow management: for managing the application approval process end to end including routing applications to the appropriate individuals or teams for review and approval.

Collaboration feature: to allow multiple users access and update the same loan application, enabling teams to work together on the approval process.

Data visualization: for users to view data in a variety of formats, such as charts and graphs, to quickly glance through key indicators and trends.

Electronic signature: for digital signing of loan documents to speed up the approval process.

Integration with other systems: such as customer relationship management (CRM) software or enterprise resource planning (ERP) software to share and exchange data.

Security features: to ensure that the dashboard is secure and access to sensitive data is restricted to authorized personnel only.

Why build a custom loan approval dashboard?

Why build a custom loan approval dashboard?

Customization: Off-the-shelf dashboards frequently lack the features or integrations with other tools that users often need to fit their unique needs.

Scalability: You can modify your custom dashboard to include new data sources, features and functionalities as your internal processes evolve.

Control and compliance: Have more control over the development, maintenance and upgrades of your dashboard and ensure you are compliant with all the relevant, evolving regulations.

Flexibility: Build a dashboard you don’t need to rebuild again in 12 months. Easily adapt to changing requirements, internal processes, and new tools and technologies.

Competitive advantage: a custom loan approval dashboard can give your team a competitive advantage by speeding up the entire approval process.

What are the challenges of building a loan approval dashboard?

What are the challenges of building a loan approval dashboard?

Complex regulations: the loan approval process must be compliant with a wide range of federal and state regulations, which can be complex and difficult to navigate.

Data integration and cleaning: It can be difficult to integrate with existing systems data as well as clean all the necessary data for the dashboard, such as credit scores, income, employment history, etc.

User experience: Providing a user-friendly and intuitive interface for the various teams to view, understand, and analyse important information can be challenging without experienced frontend engineers.

Data privacy & security: Ensure your customer data is protected from unauthorized access. You can use Appsmith’s built-in role-based access controls to set user permissions before sharing the dashboard with your end users to solve for this.

User authentication and authorization: Ensuring that the dashboard and the data it manages are protected from unauthorized access and breaches is critical, and needs a robust system that can be difficult to build from scratch.

Which teams generally use loan approval dashboards?

Which teams generally use loan approval dashboards?

Loan operations teams: to get all the information they need about loan approval management in one place.

Credit teams: to evaluate credit scores and assess the creditworthiness of the loan applicants.

Accounting and finance teams: to track and ensure that all the financial data and transactions are accurately reflected in the financial statements.

Risk management teams: to monitor the loan portfolio, identify any potential risks, and make decisions about loan approvals.

Compliance teams: to ensure that the organization adheres to all relevant regulations and laws.

Customer service teams: for responding to customer inquiries and providing assistance with the loan disbursement process.

IT teams: for checking and ensuring that the system is secure and reliable.

Sales and marketing: to understand their potential customers’ profiles better.

Why use Appsmith to build a loan approval dashboard?

Create dashboards in 30 minutes.

Use pre-built, configurable widgets such as charts (bar, line, pie charts, and more), tables, maps etc, to visualize your data as you want. With ready connectors to most popular datasources and a delightful IDE for queries, get your dashboard ready in minutes. Easily use our marketing portal template.

Bring in data from multiple datasources.

Connect to various datasources, including databases and APIs. Bind queries and JS Objects for different tables on one datasource or entirely different datasources to the same widgets as on your primary dashboard view.

Create stakeholder views and control access by role.

Customize stakeholder views on different pages of your app, make it interactive with drill-downs, and control access to data by role and groups.

What more can you do with Appsmith?

Build a fundraising CRM, a fraud monitoring tool, or a loan disbursement system. Use Appsmith to get the job done 10X quicker and with far less engineering bandwidth.

End-to-end automation

Make the entire loan approval process more efficient by allowing multiple users from different teams to access, interact with, and take actions based on different data points on the dashboard. Trigger custom alerts and notifications to specific users based on another user's action.

Get powerful features out of the box

Search, filter or sort data based on multiple criteria without writing any code - just use Appsmith’s in-built features. Paginate data in clicks with pre-built configs. Write JavaScript anywhere in Appsmith to transform your data and trigger actions elsewhere.

Built-in authentication and authorization

Access control based on user roles and display different data views to different users according to authorization settings. Utilize our built-in audit logs easily to keep track of important events and use backup and restore features as necessary.

Which industries use loan approval dashboards?

Get live support from our team or ask and answer questions in our open-source community.

Watch video tutorials, live app-building demos, How Do I Do X, and get tips and tricks for your builds.

Discord

Videos

Do more with Appsmith

Ship a dashboard today.

We’re open-source, and you can self-host Appsmith or use our cloud version—both free.